Why Solar?

Why Solar?

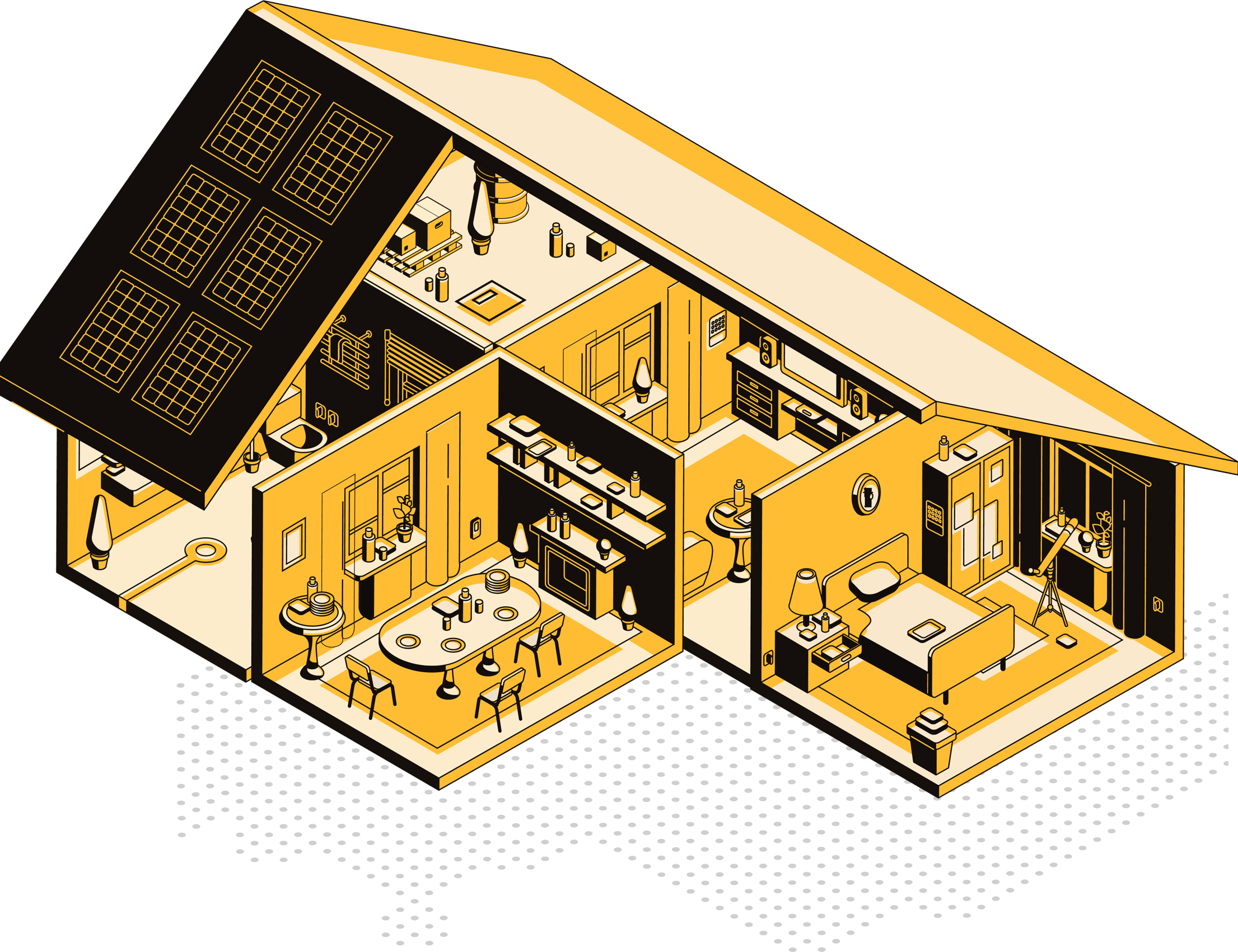

Solar can offset your entire energy bill.

The value of your home increases 4% on average.

The Federal Tax Credit takes 30% off the price.

Can be paired with battery backup for hurricane outages

$0 down payment is accessible for every owner.

Average utility bills increase annually.

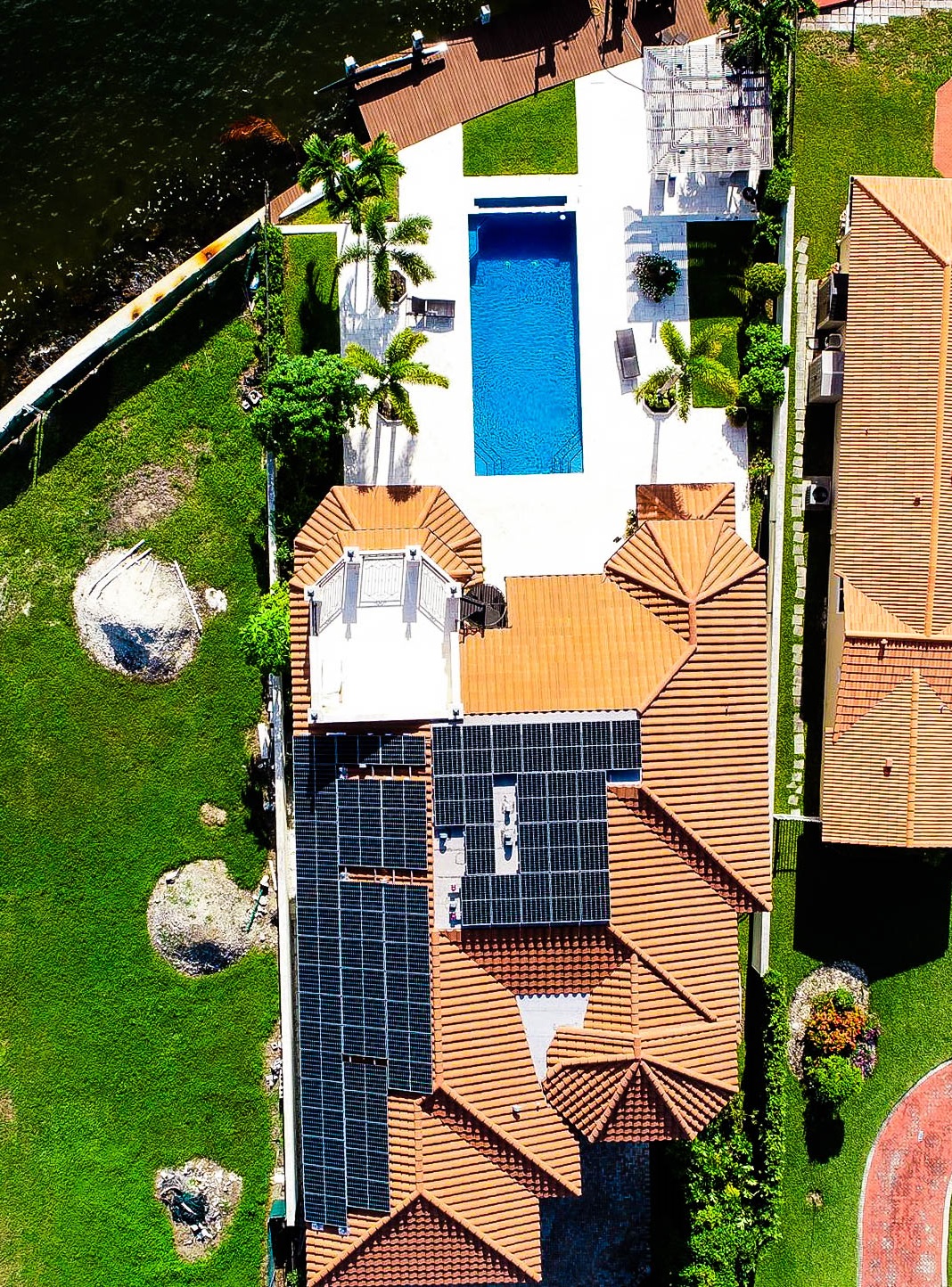

Rick Kidder, 16 kW system, saves $3,000/yr

You’ll save immediately by switching to solar.

After, you pay back the loan, you’ll own your clean

energy free and clear. Compare that to paying a $250

energy bill each month to a utility company

which can increase its rates each year.

Solar energy is crucial as a climate change solution.

Over the lifetime of a 19.53 kilowatt system, 30,000 kilowatt-hours of electricity will be produced. According to the Solar Energy Industry Association, “1.5 billion trees store as much carbon as the emissions reduced by the U.S. solar industry,” making the solar industry an important contender for reducing harmful emissions.

Sunny Isles Beach, 19.53 kW system, saves $3,600/yr

Let’s see an example.

Laila is a homeowner in Florida looking for ways to save money.

Her friends told her about switching to solar energy, but she wants to make sure it’s a safe and smart investment.

Pick your adventure:

Laila represents the average homeowner.

She currently pays $118 each month on her energy. Her Goldin Solar consultant finds she would need a 8 kW system to offset her electricity usage.

She’ll take the 26% federal tax credit.

She is able to take off a substantial $5,512 when she files her taxes the following year. This is deducted from the total loan.

Laila won’t pay anything as a down payment.

Instead of paying her electric bill, Laila will pay a monthly loan payment of $104 on a 20-year loan. That’s $14 less than what she was paying for unclean energy from the utility.

She’ll make fixed monthly payments.

She will make fixed monthly payments until her loan is paid off, after which, her only monthly bill will be the utility connection fee, around $10.

Laila represents the average homeowner.

She currently pays $118 each month for energy. Her Goldin Solar consultant finds she would need a 8 kW system to offset her electricity usage.

She’ll take the 26% federal tax credit.

Laila will receive a $5,512 credit when she files her taxes the following year. This is deducted from the effective price of the solar array.

Laila pays the full cost of her system at the beginning.

Once her system is online, her typical monthly bill will be her utility’s connection fee, around $10.

Laila will make her money back in 5-7 years.

After this period, the cash she spent going solar will be less than what she would have spent on her utility bill.

Paid back in 5-7

years

Increased home value and

building equity

Renewable, clean

energy

The bottom line

If Laila goes solar, she’ll save

money and reduce her

carbon footprint.

She’ll also improve the value of her home and impress her neighbors.

Over the next 25 years, she will save up to $51,000 and prevent 275,000 pounds of carbon dioxide from being released into the atmosphere.

But wait! What about…

...the catch?

...the catch?

You own the panels and are responsible for them. The panels need to work day in and day out.

Our panel-level monitoring platform and warranties make sure that if there is an issue, it can be recognized and addressed as soon as possible so you can keep producing energy.

...nighttime or rainy days?

...nighttime or rainy days?

Clouds and rain definitely affect panel production. If your panels aren’t producing everything your home needs at any given moment, your home will draw energy from the grid. But because our engineering process takes weather and sun hours into account, even if you consume utility energy during the night or when it’s raining, you’ll also produce more than you need during beautiful sunny days. The result is that, on average, you should produce about the same amount of energy that you consume.

...hurricanes?

...hurricanes?

We build our systems according to Miami-Dade building codes. These building codes are some of the most stringent in the world and require the systems we install to withstand 175 mph winds.

Additionally, the railings we install to mount the solar panels are typically fastened perpendicular to the rafters of a home. This creates a crossbracing effect and contributes to the structural integrity of the roof.

The bottom line is that during a hurricane, your panels are likely to be the last thing you need to worry about and they may even make your roof safer.

....financial incentives?

....financial incentives?

The best incentive in 2020 is the federal investment tax credit. This reduces your family's income tax liability by 26% of the contract price. In Florida, solar arrays are also exempt from property tax and sales tax.

...warranties?

...warranties?

Here are the products we use and the warranties associated with them.

Hanwha Q.cell Panels: 25 years production and workmanship warranty

Solar Edge Inverter: 12 years (upgradable to 25 years)

Solar Edge DC Optimizers: 25 years

Goldin Solar Workmanship: 25 years

Goldin Solar Roof Leak Protection: 25 years (or up until the expiration of your roof's warranty)

...net metering?

...net metering?

Net metering is a utility policy protected by Florida law that allows you to trade excess solar energy with the utility company for a credit you can use when your solar isn't meeting your home's energy needs.

See more

Where we do go from here?

Let’s see if solar makes sense for you. Fill out our

form and we can set up a free consultation.

855-SOLAR30